Blogs

In particular, I will speak about trick advancements regarding the European union and will mark some comparisons to the history of the device in the usa. In order to survive inside aggressive ecosystem, banking institutions need make strong relationships which have members, devise energetic cost actions, and you can position themselves for long-identity achievements because of the pursuing the correct segments and you can buyer segments. Us lender dumps declined rather in the 2022 as well as a lot of 2023 while the Fed pursued decimal tightening, nonetheless they started to get well inside the late 2023. Commercial deposits stabilized regardless of the demands posed by early 2023 local banking crisis.

PNC Digital Wallet With Efficiency See Checking/Deals -$400

Distrust away from big banks is actually widespread today, however, collapsing him or her suddenly due to a “disorderly” nationwide financial work on will be since the disastrous as it was in the newest 1930s. Before the FDIC are based from the Banking Operate of 1935, depositors consistently missing their cash when its banks ran bankrupt. Finest would be to your regulators to relax the fresh speculative SIFI wagers inside an excellent “soft landing” if possible.

Meanwhile, Todd is actually meeting with Black colored leaders within the significant metropolitan areas to convince them you to Independence can also be suffice casual experts—not simply Black People in america. Today, looking upon the fresh barren property out of a sixth-area meeting boardroom during the the headquarters, the new McDonalds admit they wish to redevelop Lake Tree Retail center. Your panels, yet not, do rates billions in order to untangle the brand new home’s courtroom woes. In addition to, Alden sees other financial headwinds in which he desires Todd getting wishing. Enter into Newsday contests and you can sweepstakes in order to earn cash awards, VIP experience seats and you will premium enjoy, gift notes to own high-stop dining, and a lot more.

Possibilities in order to Dvds

The best lender promotions give you the possible opportunity to secure useful source a life threatening bucks added bonus to have joining a new membership without charge otherwise fees which can be very easy to get waived. An educated bank incentives to you personally is actually of these that have criteria you happen to be confident with, including the amount of time you will need to keep the money regarding the membership to earn the benefit. Among the best Chase incentives available now may be worth up to help you $900 for many who discover one another a great Pursue Overall Bank account and a Chase Family savings and you can meet particular terms.

Such wire transmits taken place between the lender’s quarterly regulating reporting symptoms, allowing the experience to go 1st unnoticed. During this six-few days several months, Hanes started ten cord transfers totaling up to $47.1 million out of Heartland Tri-Condition Financial, a tiny community bank focused on farming financing, in order to a good crypto handbag he regulated. The brand new closing of one’s BTFP plus the stop of one’s contrary repo buffer, particularly if it correspond, you are going to obviously make financial institutions a lot more exposure averse and you may funds-hungry. The risk is that this all injuries the fresh cost savings to the area one to money owed pile up and then we struck various other 2008-build liquidity drama where banking companies getting wary of lending to at least one some other and also the weakened ones end up being unviable. Still, the fresh changeover might possibly be rough, that have banking institutions probably increasing financing rates and you will as smaller ready to lend.

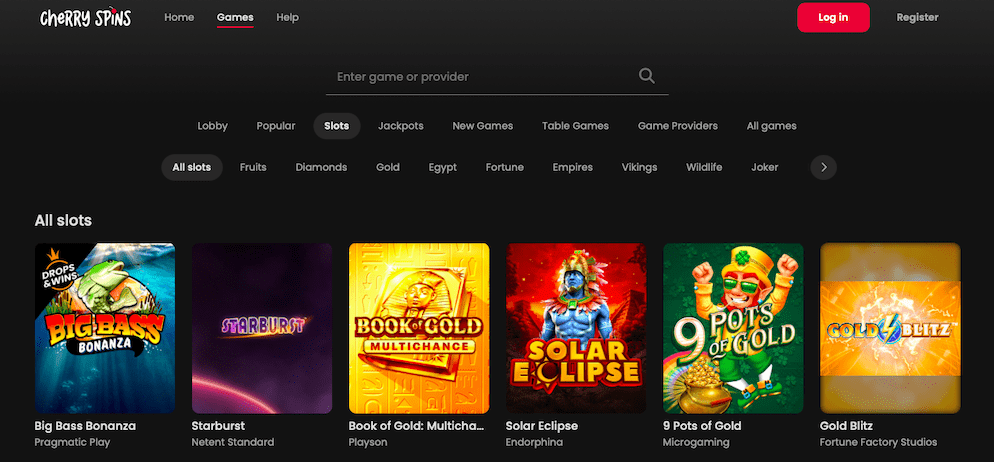

- By-the-means, the new services of playing the real deal currency and you can playing free of charge are not any some other.

- An additional experience in the Oct 2019, the new PRA flagged so you can HSBC Financial you to a customers account will get not have become noted since the eligible for settlement.

- We yourself inform so it number daily to store it up so far on the latest offers, bonuses, and will be offering.

- Though it prevented getting the brand new programs in the 2022, more than 70,000 properties have apps pending.

- The higher the newest productivity your collect the greater your likelihood of winning.

He could be interested in business economics, having completed a great Bachelors Knowledge within the 2021, and have permitting anybody else try to make sense of the fresh financial system. Although not, the fresh disappearance out of a plucky neobank is observed in the newest wider banking surroundings; APRA chairman Wayne Byres titled it a great ‘successful failure’, based on AFR account. In contrast to just what some individuals might imagine, non-bank lenders and you can neobanks are exactly as safe because the people of your big financial institutions as the are typical bound by tight regulations. Government entities make sure will not protection redraw organization – should your financial try an ADI or not. That it doesn’t matter for individuals who’lso are which have an enormous four financial otherwise an on-line low-bank bank – the us government make certain will not apply to redraw institution, complete avoid.

Financial government damaged down on businesses in the 2024 to possess abuses related to financial because the an assistance in the middle of a huge malfunction on the industry, historical currency-laundering crimes and a good litany from practices one injured consumers. Noah Taylor try a one-kid people that allows all of our blogs creators to be effective confidently and you will work on work, authorship exclusive and unique analysis. When they are done, Noah gets control of with this unique fact-examining strategy based on informative facts. The guy spends his Public relations knowledge to inquire about an element of the info having an assist team away from online casino workers. Charlotte Wilson ‘s the minds about our local casino and you can position review surgery, with well over ten years of expertise on the market. The woman options is founded on gambling establishment reviews very carefully crafted from the ball player’s perspective.

For those who open another Pursue Full Family savings and set upwards a direct deposit (of any matter) within this 3 months, you’ll secure a $300 added bonus. If you unlock a different Chase Savings account and you may put $15,one hundred thousand inside the brand new currency within 30 days and keep a $15,000 balance to own ninety days, you’ll earn an excellent $two hundred bonus. When you qualify for both of these bonuses, you’ll secure a supplementary $400, to possess a whole incentive of $900. Our better added bonus, from Chase, also offers $300 to own a primary put away from only $500 (you’ll have to satisfy added first criteria).

Axos Lender To $375 Team Premium Offers Incentive

All banks considered as probably confronted is community lenders that have less than $ten billion inside assets. Merely 16 companies are next proportions class that includes regional banking companies — between $ten billion and $100 billion in the property — even if it together hold far more property compared to 265 community banking companies combined. One departs a critical bunch of cash at risk – money from organizations, retired people, and you may family members that may fade immediately if the a bank goes wrong. The newest number reveal users in the JPMorgan Pursue, Wells Fargo and Lender from The usa try piling money to the unprotected profile.